The United States housing bubble is the economic bubble in many parts of the U.S. housing market from 2001 to 2005, especially in populous areas such as California, Florida, New York, the BosWash megalopolis, and the southwest markets. A real estate bubble is a type of economic bubble that occurs periodically in local or global real estate markets. The housing bubble in these and other parts of the U.S. was caused by historically low interest rates and a mania for purchasing houses. This bubble is related to the stock market or dot-com bubble of the 1990s.

A housing bubble is characterized by rapid increases in the valuations of real property such as housing until unsustainable levels are reached relative to incomes, price-to-rent ratios, and other economic indicators of affordability. This in turn is followed by decreases in home prices that can result in many owners holding negative equity, a mortgage debt higher than the value of the property.

Bubbles may be definitively identified only in hindsight, after a market correction.[2] The impact of booming home valuations on the U.S. economy since the 2001–2002 recession was an important factor in the recovery because a large component of consumer spending came from the related refinancing boom, which simultaneously allowed people to reduce their monthly mortgage payments with lower interest rates and withdraw equity from their homes as values increased.

http://en.wikipedia.org/wiki/United_States_housing_bubble

US housing market, US hard landing - Money Week

http://www.moneyweek.com/file/12849/is-the-us-housing-market-crumbling.html

The US housing market is different this time - it's worse

http://www.moneyweek.com/file/22805/the-us-housing-market-is-different-this-time---its-worse.html

Most Over/UnderValued U.S. Housing Markets

http://usmarket.seekingalpha.com/article/38828

The Bank of International Settlements issued a warning yesterday that underscored just how serious the Real Estate Bust has become.

http://www.bitsofnews.com/content/view/5774/43/

"Virtually nobody foresaw the Great Depression of the 1930s, or the crises which affected Japan and southeast Asia in the early and late 1990s. In fact, each downturn was preceded by a period of non-inflationary growth exuberant enough to lead many commentators to suggest that a 'new era' had arrived", said the bank.

The BIS, the ultimate bank of central bankers, pointed to a confluence a worrying signs, citing mass issuance of new-fangled credit instruments, soaring levels of household debt, extreme appetite for risk shown by investors, and entrenched imbalances in the world currency system.

In a thinly-veiled rebuke to the US Federal Reserve, the BIS said central banks were starting to doubt the wisdom of letting asset bubbles build up on the assumption that they could safely be "cleaned up" afterwards - which was more or less the strategy pursued by former Fed chief Alan Greenspan after the dotcom bust.

It said this approach had failed in the US in 1930 and in Japan in 1991 because excess debt and investment built up in the boom years had suffocating effects.

The bank said it was far from clear whether the US would be able to shrug off the consequences of its latest imbalances, citing a current account deficit running at 6.5pc of GDP, a rise in US external liabilities by over $4 trillion from 2001 to 2005, and an unpredented drop in the savings rate. "The dollar clearly remains vulnerable to a sudden loss of private sector confidence," it said.

Bloomberg had an article on the same report but focused on different aspects.

The possibility of a slump in real estate markets remains "a significant risk to financial stability," while the growth in securitization has spread "direct and indirect" risk across the financial system, the BIS said.

"Who now holds these risks, and can they manage them adequately?" the report asked. "The honest answer is that we do not know."

Much of the risk is contained in various forms of asset- backed securities of "growing complexity and opacity" that have been purchased by banks, pension funds, insurance companies and hedge funds.

"Hedge funds might be most exposed, since many have tended to specialize in purchases of the riskiest sorts of these instruments," the report said.

Speaking of hedge funds and subprime loans, that brings us to the most pressing financial news of the month.

Financial giant Bear Stearns, unveiled a $3.2 Billion bailout plan last week for its failing hedge funds that specialize on risky mortgages, after it lost 23% of its net worth in just four months. This is the largest hedge fund bailout since Long-Term Capital Management went bust in 1998 and almost took out the global bond market with it. The bailout failed to rescue them, as Merrill Lynch seized $800 million of the hedge fund assets and sold them on the open market.

This is an ironic turn of events. Back in 1998 Bear Sterns refused to join its rivals in the bailout of LTCM. Nine years later Bear Sterns asked its rivals for a bailout and they refused.

This comes less than two months since another financial giant, UBS, shut down its hedge fund after $120 million in losses in the subprime mortgage market. Today, a U.K. hedge fund is reporting massive losses from its exposure to the subprime market. This appears to be the leading edge of a massive financial fallout.

What is approaching is a repricing of risk. What that means is that mortgage bonds that have been repackaged and sold on the open market will be downgraded as the rating agencies finally (belatedly) acknowledge that the risk of default on those bonds was much higher than admitted when they were originally sold. That means that the organization that bought those bonds, purchased overvalued bonds.

In the first of what is expected to be a wave of downgrades, Moody's has cut the rating of 131 subprime bonds because of higher-than-expected defaults. It is reviewing hundreds more. [...]

Subprime, says Mr Arbess, might well be “a dress rehearsal for something bigger and scarier.”

The Collaterized Debt Obligation market (CDOs) has been understating risk and overstating price for some time now.

Amongst others, Bear Sterns would create a CDO in a bundle according to a client’s specifications. Indeed, Bear Sterns would work with a rating agency, such as Moody’s, to obtain the desired rating (a practice likely to face more scrutiny as some allege that Moody's no longer acts as an independent rating agency, but as a syndicator in the offering). The explosive demand in this sector has attracted ever more creative structures. Investors should have grown concerned when dealmakers started suggesting that one can create a higher grade security by grouping together a couple of lower grade securities; it is rare that 1+1 equals 3. As these instruments have grown more complex, the clients buying these instruments often do not have a full understanding of what they buy.

[...]

The risk to the financial system was not merely that some large brokerage firms may have been forced to write down a couple of hundred million dollars – they may still have to do that. But had the fire sale gone through, market values would have been available to the securities sold. This in turn would have forced other lenders to revalue the collateral they hold; and as the collateral is worth less, the brokers will lend less money. That would have triggered further margin calls, further forced liquidations. When hedge funds implode, they tend to sell off more liquid assets first; at the end of the sale, the prices of the liquid assets are depressed, yet the fund may still be left holding illiquid securities.

The most troubling element of this real estate bust is that there is little reason to believe that we've hit bottom yet. Most of the subprime and Alt-A borrowers ( Alt-A's are one step up from subprime, and usually using an "exotic" mortgage to get into a house they may not be able to afford) used a "2/28". Which means 2 years at a low "teaser" interest rate, then their mortgage resets to a much higher market rate. Most of those 2/28's are about to reset.

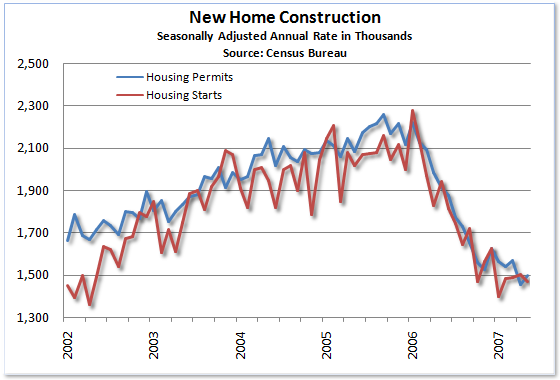

The inventory of unsold houses on the market hit a 15-year high today. This comes at the same time that the National Association of Realtors are predicting their first annual national decline in median housing prices in 40 years. This is happening at the same time that the home building industry is collapsing at its fastest rate in 32 years. 86 major mortgage lenders have gone bankrupt since late 2006. Rates on a 30-year mortgage just hit a 10-month high.

All this pain in the real estate market has led the Democratic Congress to propose taking away some of the Federal Reserve's regulatory power because it has failed to use it.

On the borrowers side, subprime households tend to not understand what they are getting into.

· Nearly nine out of 10 borrowers could not identify the correct amount of upfront charges connected with a loan.

· Four out of five had trouble understanding why the stated interest rate on the loan note was different from the annual percentage rate, or APR, highlighted in the truth-in-lending disclosure.

· Two-thirds did not spot a potentially dangerous snare lurking in the loan -- a substantial penalty if they refinanced within the first two years.

US home sales continue downwards

http://news.bbc.co.uk/2/hi/business/6238200.stm

The US housing market remained sluggish last month, latest figures have shown, with sales of existing homes at their lowest level in four years.

Sales fell 0.3% to 5.99 million units in May, the slowest pace of growth since summer 2003, according to the National Association of Realtors (NAR).

Sales are now 10% lower than a year ago, when 6.68 million units were sold.

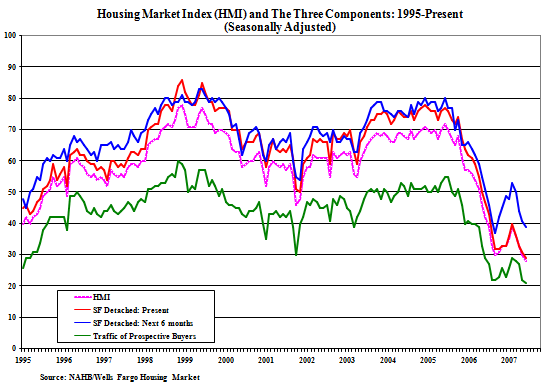

The sharp downturn in the housing market, after years of stellar growth, has shown little sign of bottoming out.

The number of unsold homes rose 5% to 4.43 million units.

Brittle confidence

Lack of confidence in the market has had an impact on the broader state of the US economy, with GDP growth falling to 1.3% in the first three months of the year.

Several experts have lowered their growth forecasts for the whole of 2007, citing the weakness in the housing sector.

The National Association of Business Economists (NABE) cut its forecast for economic growth from 2.8% to 2.3%.

The NAR measures house prices by their median point, the exact spot between the lower and upper half of prices.

The median price of an existing US home is now $223,700 (£119.000), 2.1% less than the midpoint value in May 2006.

US home sales slump; no relief expected from Fed

http://servihoo.com/channels/kinews/afp_details.php?id=166103&CategoryID=47

Sales of existing US homes fell in May to their lowest level in four years, dashing hopes for a rebound in the struggling property market, an industry report showed Monday.

The National Association of Realtors (NAR) said existing home sales dropped 0.3 percent to an annualized pace of 5.99 million last month. Most economists had forecast a sales clip of 6.00 million properties.

The snapshot also showed that the glut of millions of homes flooding the market rose to a record high for a second straight month.

Its release comes days before Federal Reserve policymakers are due to deliberate US interest rates, although most Fed-watchers expect the central bank to keep rates on hold amid fears about inflationary pressures.

"The housing market may not be in a free fall but it has not hit bottom yet either. We still seem to be in the sellers' denial phase of the market," said Joel Naroff of Naroff Economic Advisors.

The association blamed the sales drop, the third straight monthly fall, largely on a dwindling number of buyers ready to commit to an expensive property purchase.

"I think psychological factors are currently the biggest drag on the housing market, in addition to a disruption from tighter credit for subprime borrowers," said NAR economist Lawrence Yun.

Experts say tighter mortgage lending standards, particularly for Americans with patchy credit histories, and mounting home foreclosures have also harmed sales.

The monthly report also revealed that the number of homes for sale across America continued to rise last month, increasing five percent from April to a record inventory of 4.43 million properties.

That represents an 8.9-month supply at the current sales pace, according to the NAR. It is also marks the second straight month that the inventory of unsold homes has struck a record.

The number of unsold properties swamping the market has ballooned by 23.5 percent in the past year, as market dynamics have switched dramatically to favor potential buyers over sellers.

The monthly snapshot also showed that falling prices -- following a long boom in the property market that ended last year -- failed to drum up improved demand going into the summer months as sales fell to their lowest level since June 2003.

The median home sales price declined 2.1 percent to 223,700 dollars compared with May 2006.

"Global Insight does not expect home sales to turn around until at least the middle of next year," said Patrick Newport, an economist at the firm, noting that mortgage securities fears had also roiled Wall Street in the past week.

The US stock markets ended lower Monday as concerns about mortgage-related securities continued to unsettle investors.

The US property market has been in a slump for over a year, partly as consumers have been buffeted by spiking gasoline costs.

The NAR report is not likely to make happy reading for Fed chairman Ben Bernanke ahead of Wednesday's two-day Fed meeting.

The Fed would normally be expected to cut interest rates in such times to give homeowners some relief, but the Fed has been preoccupied with fighting inflationary threats such as surging oil prices.

The central bank is widely expected to keep its key fed funds rate anchored firmly at 5.25 percent this week, where it has been for a year.

Naroff said the troubled state of the market, however, will soon force the Fed to focus on housing more fully, especially because of its knock-on effect on the wider economy which has slowed significantly in the past 12 months.

The latest NAR figures showed existing home sales are a hefty 10.3 percent below the 6.68 million-unit pace of May 2006. The association revised its reading of April sales slightly to 6.01 million from an initial estimate of 5.99 million homes.

Has housing market bottomed out?

Sales of existing homes fell in 2006 at fastest rate in nearly 20 years

http://www.msnbc.msn.com/id/16812267/

The final housing numbers for 2006 are in, and they confirm what anyone who bought or sold a home last year has suspected: It was the worst housing slump in nearly two decades.

The freshest numbers also provided tea leaves for the more pressing question: has the housing market bottomed out yet — or will prices slide further before the market recovers?

After a historic five-year boom propelled by a strong economy and low interest rate, the real estate market went bust in 2006, according to the final tally released Thursday by the National Association of Realtors. Sales of existing single-family homes fell 8.4 percent to about 6.5 million, the biggest annual decline since a 14.8 percent drop in 1989.

Like everything in real estate, a lot depended on location, location, location. The West — which had seen outsized gains during the boom — was hit hardest by the slump, with sales off nearly 16 percent last year. Sales in the South were down 7 percent, while the Midwest and Northeast saw sales fall nearly 6 percent for the year.

Double-digit price gains that sparked a frenzy of condo flipping and speculative building also came to an abrupt halt last year. The median price of an existing home rose just 1.1 percent last year — less than inflation — compared with 12.4 percent in 2005.

Those numbers have driven away much of the quick-buck crowd that loaded up on unbuilt condos and helped fuel the rapid rise in prices. In 2005, some 40 percent of the market represented investment or second-home purchases. Comparable figures for 2006 were not yet available, but the departure of those investors should help stabilize the market, according to David Lereah, chief economist at the National Association of Realtors.

“With fingers and toes crossed, it appears that we have hit bottom in the existing-home market,” he said.

The trade group's official forecast calls for a 1.2 percent drop in sales of existing homes this year and a 1.5 percent increase in the median price.

Some market watchers note that at 6.5 million sales a year the pace of homes sales is still strong by pre-boom standards. And there are signs that the slump is easing, if not reversing course. Brian Wesbury, chief economist First Trust Advisors, notes that lumber prices, mortgage activity and some homebuilder stocks have begun to pick up.

“It looks to me as though maybe we haven't reached the complete bottom yet, but we're in the bottoming phase right now,” he said.

But the latest data don’t help forecasters much. Since July, the median price of existing homes has trended lower, but it ticked up slightly in December. And while sales volume began perking up in late 2006, a 0.8 percent drop in last month has some analysts rethinking the notion that the market had bottomed out.

“I still think there's further downside risk,” said Richard Berner, chief U.S. economist at Morgan Stanley. “And the reason is that it has become a buyer’s market with the imbalance between supply and demand both for new and existing homes out there.”

The supply of unsold homes — which soared to more than seven months worth of inventory for single-family homes from four months at the start of 2005 — has come down a bit. But it’s not clear whether the market is getting back on its feet or sellers have decided to pull their homes off the market and try again when the market improves.

“We could see inventories go back up again in the existing-home market when people come back into the marketplace in the spring,” said Berner.

Economists have long taken housing sales and construction statistics for December with a big grain of salt. For one thing, the data are seasonally adjusted from a relatively small base, which tends to amplify monthly trends. The real test usually doesn’t come until spring, when the start of the season typically brings new buyers and sellers to market.

The good news is that — unlike some past housing slumps — this one doesn’t look like it’s going to drag the overall economy down with it. Unemployment remains low, consumers seem to be weathering the housing downturn reasonably well, and interest rates are still in check.

“While there is no denying that housing will continue to act as a drag on real GDP growth in the opening half of this year, the housing market whirlpool will not drag the rest of the U.S. economy down with it,” said Stuart Hoffman, chief economist at PNC, in a note to clients Thursday.

The strength of the housing market, in turn, depends on a strong economy generating new jobs and rising wages for potential home buyers. Any rebound will also depend on a continued of low interest rates and relatively easy credit.

That could change if consumers don’t get a handle on record levels of debt. With some borrowers in over their heads and a rise in credit delinquencies, mortgages may be harder to come by, especially among lower-income home buyers, said Berner.

“What I worry about is that some of the lenders may start to pull back and make housing a little less affordable for people at the fringes of the marketplace,“ he said.

Lennar posts loss, says housing market may worsen

http://investing.reuters.co.uk/news/articleinvesting.aspx?type=tnBusinessNews&storyID=2007-06-26T123014Z_01_KIM636900_RTRIDST_0_BUSINESS-LENNAR-RESULTS-DC.XML

NEW YORK (Reuters) - Lennar Corp. (LEN.N: Quote, Profile , Research), the second-largest U.S. home builder, posted a quarterly loss on Tuesday, forecast a loss in the current quarter and warned that the housing market could deteriorate further.

"As we look to our third quarter and the remainder of 2007, we continue to see weak, and perhaps deteriorating, market conditions," Stuart Miller, chief executive, said in a statement.

"Given uncertain market conditions, we continue to lack visibility as to future results, but we currently expect to be in a loss position in our third quarter," he said.

Lennar recorded a net loss of $244.2 million, or $1.55 a share, for its fiscal second quarter, ended May 30, compared with a profit of $324.7 million, or $2 a share, a year earlier.

The results included charges of $329 million, or $1.33 per share, for a loss of land sales, which included a write-down of land values and write-offs of deposits on land options.

Before charges, the company lost 23 cents per share, while analysts expected a profit of 1 cent per share, according to Reuters Estimates.

Wall Street expects the company to earn 20 cents per share before items in the current quarter.

The U.S. housing market has been suffering from a steep downturn for more than a year as high prices and climbing interest rates have deterred prospective buyers. Speculators also have retreated from the market, unloading homes bought as short-term investments.

The industry is grappling with a downturn in demand and a glut of supply. Home builders have responded, cutting prices, adding freebies and shrinking their businesses to wait out the downturn. Lennar said incentives to invigorate sales ate into quarterly gross margins, which fell to 13.6 percent from 23.7 percent in 2006.

Lennar's home-sale revenue fell 33 percent to $2.7 billion, as the number of homes declined 29 percent. Signed prospective buyers canceled their orders at a rate of 29 percent.

The average selling price of a Lennar home dropped 7 percent to $298,000.

New orders during the quarter fell 31 percent to 8,056 homes, excluding unconsolidated businesses.

Shares of Lennar on Monday closed at $38.75 on the New York Stock Exchange. Year-to-date, Lennar shares are down 26 percent, while the sector is off 24 percent, according to the Dow Jones U.S. Home Construction Index <.DJUSHB>.

According to BuilderOnline, Lennar overtook Pulte Homes Inc. (PHM.N: Quote, Profile , Research) as the No. 2 U.S. home builder, as measured by the number of homes sold last year, behind D.R. Horton Inc.(DHI.N: Quote, Profile , Research)

Home Prices and the Economy

How to Play the Real Estate Crash

Buyers continue to wait out housing market

http://www.venturacountystar.com/news/2007/jun/26/buyers-continue-to-wait-out-housing-market/

The waiting game.

Many homebuyers and sellers are familiar with the concept, watching from the sidelines, afraid to gamble on the slow housing market.

Prospective buyers worried about falling real estate prices are staying away, which is the real reason that there's been a big drop in sales activity, said Bill Watkins, director of the UC Santa Barbara Economic Forecast Project.

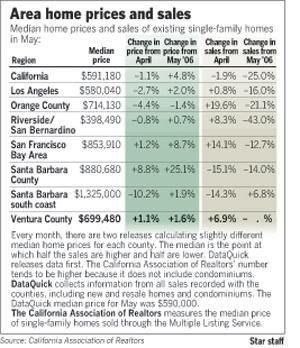

In a year-over-year comparison, home sales in May continued to slide in double-digit percentages, extending a cooling off period that began in late 2005.

But Deborah Poole, a Realtor with Troop Real Estate in Oxnard, says now is a great time to buy. She describes Ventura County's housing market as realistic and priced fairly, while interest rates are still at historically low levels.

Ventura County's median sales price for an existing single-family home was $699,480 in May, the fourth-highest mark since January 1990. The next highest medians were posted last year in June, July and August, when the record of $710,906 was set. The median is the midpoint, where half the homes sell for less and half for more.

The county median increased 1.1 percent from $691,710 in April and 1.6 percent from $688,440 in May 2006, the California Association of Realtors reported Monday.

It doesn't mean that prices are rising across the board in the county, CAR Vice President Leslie Appleton-Young said.

"Prices have plateaued in Southern California," Appleton-Young said. "Prices are reflecting a change in the composition of what's selling."

The decline in sales is driven by tighter loan standards and negative news about foreclosures and subprime loans, she said, adding that the lower end of the market has suffered the most from problems with subprime loans, with sales falling off and prices weakening.

The market's strongest segment has been at the top, Watkins said. He expects the median to linger around $700,000 for about a year, with sales volume either declining or stabilizing.

"Prices are holding firm, which reflects the lack of necessity for most sellers to sell their house," Watkins said. "They're just going to wait it out."

Ventura County sales climbed 6.9 percent in May from April, but fell 25.3 percent from the same month last year.

"We're hopeful that sales volume picks up toward the fall," Watkins said.

Ventura County had a 2.4-month supply of unsold inventory in May, compared with 38.4 days a year ago.

"That's among the lowest in Southern California," Appleton-Young said.

San Diego's unsold inventory was 9.2 months, while California's was 10.7 months. Unsold inventory indicates the number of months needed to deplete the supply of homes on the market at the current sales rate.

Poole suggested that the best time to buy is now until the end of the year, before an anticipated fall in interest rates next year drives prices up and swings the market back in favor of sellers. Some lenders expect interest rates to drop significantly around March because next year is an election year, Poole said.

Watkins disagrees.

"I don't think that this Fed would cut interest rates to influence a presidential election," he said. "I think there's still a concern with inflation and very low unemployment, and so at least in the next six months, it's much more likely the Fed will increase rates than decrease rates."

Poole predicts a gradual increase in activity for the rest of the year, a pattern that echoes the first half of 2007.

"It's not the mad frenzy you had a few years ago, where buyers had to make a decision in two hours, and sometimes there were 20 counteroffers," she said. "It was crazy."

Homes priced correctly are still flying off the market in a few weeks, she said. The transactions she's handled have averaged 90 days, she said.

The Ventura County homes sold in May were on the market for a median 51.7 days, up from 44.5 days a year ago, CAR reported.

In California, the median price of an existing home was $591,180 in May, a 4.8 percent increase from $563,860 a year ago, CAR reported. The state's median price decreased 1.1 percent compared with $597,640 in April.

Closed escrow sales statewide totaled 366,370 in May at a seasonally adjusted annualized rate, down 25 percent from 488,260 sales over the same period a year ago, according to CAR. The statewide sales figure represents what the total number of homes sold during 2007 would be if sales maintained the May pace throughout the year.

Nationally, sales of existing homes fell for the third straight month in May, dropping to the lowest level in four years as the median sales price declined for a record 10th consecutive month.

Sales fell by 0.3 percent in May to a seasonally adjusted annual rate of 5.99 million units, the National Association of Realtors reported. Sales now stand at 10.3 percent below where they were a year ago.

The median price of an existing home sold last month fell to $223,700, down 2.1 percent from a year ago.

ConsumerAffairs.com - Foreclosures

The loss of a dream

Skyrocketing foreclosures a tragedy that is still unfolding

http://www.telegram.com/article/20070624/NEWS/706240426/1002/BUSINESS

WORCESTER— A small cluster of men stood in the rain at 2 p.m. Friday outside 273 Cambridge St., a beige three-decker with a blue minivan parked in the driveway. Without walking through the three-family wood frame building, Michael G. Roy of Commonwealth Auction Associates opened the bidding.

A couple of minutes later, the property, which sold for $304,122 in March 2005, was awarded to the bank that foreclosed on it. There was one other bidder. The auction price was not disclosed.

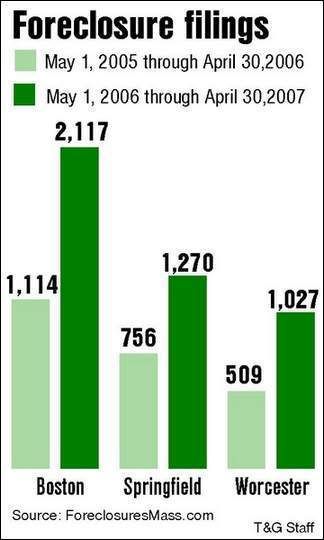

The brief foreclosure auction was one of several scheduled to take place Friday in Worcester, a city which has seen a 102 percent increase in foreclosure filings in the last 12 months. There were 509 filings in the 12-month period that ended April 30, 2006, and 1,027 for the same period ended April 30, 2007.

Worcester had the third-highest foreclosure numbers in the state, trailing only Boston and Springfield. And while foreclosure numbers statewide are expected to rise in the short term, efforts are being made to mitigate some of the underlying causes.

Worcester had 237 filings for foreclosure in 2003, followed by 308 the following year and 445 in 2005, according to data provided by ForeclosuresMass.com. Last year there were 850 foreclosure proceedings initiated in the city, and the city is on track to pass 1,100 this year.

Jeremy B. Shapiro, president of ForeclosureMass.com, which tracks foreclosure data, said the problem will not get better in the short term, even with government relief efforts.

“When you look at the increase from last year, it’s astronomically high, and even if it remains flat, it’s still double what we’ve seen in the past year,” he said

While not every foreclosure filing results in the property being auctioned — some homeowners are able to refinance, make up delinquent payments or sell the property before auction — the filings are an indicator of a range of problems affecting homeowners’ ability to meet the terms of their loans.

In response to the statewide and national rise in foreclosures, the state Commissioner of Banks, Stephen L. Antonakes, convened a mortgage summit last November with government, nonprofit and mortgage lending officials to develop a foreclosure prevention strategy. Two working groups that met in the following months came up with a list of recommendations for legislators, regulators, mortgage lenders and nonprofit groups to address some of the key causes, among them, subprime and nontraditional loans and mortgage fraud.

Since then, Gov. Deval L. Patrick called for the criminalization of mortgage fraud, better tracking of foreclosures, and a public education campaign for would-be homeowners. The governor said the state needs to provide better information for consumers before they take out a mortgage. The state also needs to create tougher regulatory controls over brokers and lenders and offer legal help for homeowners facing foreclosure, he said.

The governor’s recommendations are in line with some put forth by the working groups, which also called for raising the standards for applicants to become licensed as a mortgage lender or broker and increased funding for pre- and post-purchase homebuyer counseling.

Attorney General Martha Coakley imposed a 90-day moratorium on so-called foreclosure rescues, schemes that entice homeowners facing foreclosure to sign over their property to a temporary purchaser under the false hope it will help them keep the home over the long run. She argued that the practice robs at-risk homeowners of what little equity they have in their homes, and never helps families keep their properties for more than a short time.

Mr. Antonakes said his office will hold a hearing July 10 on setting higher bonding and educational requirements for mortgage brokers. He also plans to create a mortgage fraud unit in his office. At Mr. Patrick’s direction, the Division of Banks is helping consumers going through, or are in danger of foreclosure, he said. Since April 30 the office has fielded more than 500 calls, about half from people already in the foreclosure process, and the others from people who are having trouble making mortgage payments.

“When we take these calls, we refer them to counseling firms, and lay out a course of action available to them,” he said. “We’re reaching out to lenders, and we’ve been seeking a 30-to-60-day stay in the process. We encourage them to work with consumers to see if something can be done short of foreclosure.”

So far, the division has been able to get stays for about 80 percent of the callers seeking help.

Still, a large number of variable-rate mortgages in the state will reset this year and next, leading to more borrowers facing heftier payments, he said.

The skyrocketing real estate market a few years ago prompted some brokers and mortgage companies to lend money to people with poor or no credit, and sometimes provided them with loans unsuitable for their income. Those variable-rate mortgages and subprime loans are cited as a large factor in the escalating foreclosure problem. As the low introductory interest rates readjust — often sharply — borrowers sometimes find that they cannot meet the higher monthly payments. Economists have said a concentration of foreclosures in a neighborhood can have the effect of devaluing the area, not just those properties being foreclosed on. And with data showing that foreclosures are pretty evenly distributed around the city, Worcester officials say that they have yet to see any detrimental impact.

“They seem to be scattered around the city,” said Scott M. Hayman, director of housing for the city. “We have some vulnerable neighborhoods where we’ve seen foreclosures. I think the impact remains to be seen. I see a lot of for-sale signs. That’s an indicator of resets,” he said, referring to adjustable-rate mortgages that have an increase in interest rates after the first two years of lower rates.

Mr. Hayman said in some cases lenders are not letting the properties sell at auction unless they receive a bid they consider high enough. Some of the city’s community development corporations have gone to foreclosure auctions and bid, but were turned away by the lenders, he said. The CDCs renovate auctioned and abandoned property for sale to first-time homebuyers.

“I have seen cases where people bought over their heads,” he continued, mentioning a borrower who should not have been a candidate for a loan, but received one, then took out another to make repairs on the second floor, which was uninhabitable when he bought the property. When higher rates kicked in when the loan reset, the owner didn’t obtain help or work with the lender and was foreclosed upon, he said.

Part of the national foreclosure problem is borrowers who don’t act when they receive foreclosure notices, he said. Help is available through programs offered by the Community Action Council and NeighborWorks Home Ownership Center, which provide some financial literacy to homebuyers, he said.

“We try to get more people to reach out earlier in the process,” he said. “We can’t turn the tide of a nationwide trend, but we can help people survive if we can get to them soon enough.”

He said that if the lender will grant a temporary stay on collection of payments, it can give the borrower time to work out alternative arrangements. Property owners with an extra unit are encouraged to rent them out for income that could help in mortgage payments, he said.

Priscilla A. Holmes, deputy director of the Community Action Council, an anti-poverty agency, said her organization has helped 10 people buy homes through its Individual Accounts Program. It provides first-time homebuyer classes and uses matching funds to help them with the purchase. None of the program’s graduates, including several immigrants, has fallen into foreclosure, she said.

“This is a serious trend, and we want to play whatever role we can,” she said, referring to the escalating foreclosure rate.

The program, which is not limited to home buying, has received funding for nine more low-income people to enroll.

“They get six to eight weeks of financial literacy,” she said. “We have a banker come in and talk about the banking industry and the mortgage industry.”

Francis D. Paquette, director of the NeighborWorks Home Ownership Center, which provides foreclosure prevention counseling, said he is getting an increasing number of calls.

“It’s getting to be a rather large problem,” he said.

Subprime loans and creative financing have received a lot of blame for the problem, but it comes down to a range of factors, he said.

“They had deaths, divorce, unusually high medical problems,” he said. “Life happens. Money gets diverted to other things. Some don’t have financial reserves to right the ship.

“A couple of years ago ARMs (adjustable-rate mortgages) were prevalent. Now, some of them are under the gun because their monthly payments are going up. The adjustable rates are killers. They don’t realize that their income is not going to match the higher payments.”

Mr. Paquette said some lenders were careless in reviewing loan applications, awarding mortgages to clients who would run into trouble when their interest rates adjusted upward.

“In some cases there were bad lending practices by some lending companies. They probably knew they (borrowers) wouldn’t have been able to make payments down the road, but they got their payment and commissions, and the mortgage has probably been sold a couple of times.”

Housing experts said recent government intervention will cure future problems but are of little use for those battling current foreclosure issues.

Getting the lender to temporarily stay collection of payment can provide some help, but that is only effective if the owner can pay the mortgage once some adjustments have been made, Mr. Shapiro said. Homeowners trying to dodge foreclosure by selling their property have another problem: A slumping real estate market marked by falling prices and a glut of homes.

“In a market like this, if the homeowner is being proactive and sees that he’s not going to be able to make the payments when the loan adjusts in a couple of months, there’s a good chance the property won’t be sold,” he said. “A lot of homeowners find themselves in the situation where they’re damned if they do and damned if they don’t. If they try to refinance, their monthly payment is going to be higher than what they’re currently paying.”

Tracking Foreclosures

Foreclosure Fears

U.S. Foreclosure Rate Increases 90 Percent

http://www.thetrumpet.com/index.php?page=article&id=3286

If you want to buy a home at a bargain price, then today’s housing market is just for you. America’s cooling housing market is not only driving builders of new homes to slash their asking prices, but it is also precipitating a rise in the number of foreclosed homes going up for sale.

According to RealtyTrac, a large real estate data company, U.S. home foreclosures in May 2007 jumped 90 percent over May 2006. Foreclosures in May increased by 19 percent over April. The number of foreclosure filings for May was the highest recorded since RealtyTrac began recording foreclosure figures in 2005.

“After a barely perceptible dip in April, foreclosure activity roared back with a vengeance in May,” said James Saccacio, chief executive officer of RealtyTrac. And it appears the worst is yet to come. “Such strong activity in the midst of the typical spring buying season could foreshadow even higher foreclosure levels later in the year,” he said. “Certainly not every community nationwide is seeing an increase in foreclosures, but foreclosed properties are becoming more commonplace and adding to the downward pressure on home prices in many areas.”

Some states are being hit harder than others. California, Nevada, Colarado, Florida and Ohio lead the nation in foreclosures. In May alone, 39,659 homes went into foreclosure in California.

The massive jump in the number of homes falling into foreclosure in America is another sign of economic trouble in the U.S., and it will only get worse.

For years now, millions of Americans have been gorging themselves on new flatscreen tvs, exotic vacations, bigger homes, new cars, and major home improvements. This spending spree was induced in large part by an inexpensive and creative housing sector. Banks and finance companies designed creative new loans to help people purchase bigger, more expensive homes, or use up the equity from their existing homes. Credit flowed like water. Subprime lenders irresponsibly lent money to people they knew simply had no way to repay the loan.

Now, all this financial mismanagement is boomeranging back.

As the housing market cools and more and more people crumble under the weight of their self-imposed financial burdens, America’s romance with gluttony and materialism will come to a close. Times are clearly getting tougher.

If you are interested in stablizing your finances and building some financial security, read “Storm-Proof Your Financial House.”

CNBC Global Exchange - US Housing Market

US Housing Crash Continues

It's A Terrible Time To Buy

Why?

http://patrick.net/housing/crash.html

Prices still disconnected from fundamentals. House prices are still far beyond any historically known relationship to rents or salaries. Rents are less than half of mortgage payments. Salaries cannot cover mortgages except in the very short term, by using adjustable interest-only loans. Anyone who buys now will suffer losses immediately, and for the next several years at least.

Buyers borrowed too much money and cannot pay the interest. Now there are mass foreclosures, and senators are talking about taking your money to pay for your neighbor's McMansion.

Banks happily loaned whatever amount borrowers wanted as long as the banks could then sell the loan, pushing the risk onto Fannie Mae (ultimately taxpayers) or onto buyers of mortgage backed securities. Now that it has become clear that a trillion dollars in mortgage loans will not be repaid, Fannie Mae is under pressure not to buy risky loans and investors do not want mortgage backed securities. This means that the money available for mortgages is falling, and house prices will keep falling, probably for 5 years or more.

A return to traditional lending standards will mean a return to traditional prices, which are far below current prices.

Interest rates increases. When rates go from 5% to 7%, that's a 40% increase in the amount of interest a buyer has to pay. House prices must drop proportionately to compensate.

For example, if interest rates are 5%, then $1000 per month ($12,000 per year) pays for a loan of $240,000. If interest rates rise to 7%, then that same $1000 per month pays for a loan of only $171,428.

Even if the Fed does not raise rates any more, all those adjustable mortgages will go up anyway, because they will adjust upward from the low initial rate to the current rate.

Extreme use of leverage. Leverage means using debt to amplify gain. Most people forget that losses get amplified as well. If a buyer puts 10% down and the house goes down 10%, he has lost 100% of his money on paper. If he has to sell due to job loss or an interest rate hike, he's bankrupt in the real world.

It's worse than that. House prices do not even have to fall to cause big losses. The cost of selling a house is 6%. On a $300,000 house, that's $18,000 lost even if prices just stay flat. So a 4% decline in housing prices bankrupts all those with 10% equity or less.

Shortage of first-time buyers. The percentage of San Francisco Bay Area households who could afford a median-price house in the region plunged from 20 percent in July 2003 to under 10 percent in 2006.

Surplus of speculators. Nationally, 25% of houses bought in 2005 were pure speculation, not houses to live in, and the speculators are going into foreclosure in large numbers now. Even the National Association of House Builders admits that "Investor-driven price appreciation looms over some housing markets."

Fraud. It has become common for speculators take out a loan for up to 50% more than the price of the house he intends to buy. The appraiser goes along with the inflated price, or he does not ever get called back to do another appraisal. The speculator then pays the seller his asking price (much less than the loan amount), and uses the extra money to make mortgage payments on the unreasonably large mortgage until he can find a buyer to take the house off his hands for more than he paid. Worked great during the boom. Now it doesn't work at all, unless the speculator simply skips town with the extra money.

Baby boomers retiring. There are 77 million Americans born between 1946-1964. One-third have zero retirement savings. The oldest are 61. The only cash they have is equity in a house, so they must sell.

Huge glut of empty housing. Builders are being forced to drop prices even faster than owners. They overbuilt and have huge excess inventory that they cannot sell at current prices.

The best summary explanation, from Business Week: "Today's housing prices are predicated on an impossible combination: the strong growth in income and asset values of a strong economy, plus the ultra-low interest rates of a weak economy. Either the economy's long-term prospects will get worse or rates will rise. In either scenario, housing will weaken."

Attorney Jack Garson on the changing real estate market

US Housing Market Crash to result in the Second Great Depression

http://www.marketoracle.co.uk/Article383.html

This week’s data on the sagging real estate market leaves no doubt that the housing bubble is quickly crashing to earth and that hard times are on the way. “The slump in home prices from the end of 2005 to the end of 2006 was the biggest year over year drop since the National Association of Realtors started keeping track in 1982.” (New York Times) The Commerce Dept announced that the construction of new homes fell in January by a whopping 14.3%. Prices fell in half of the nation’s major markets and “existing home sales declined in 40 states”. Arizona, Florida, California, and Virginia have seen precipitous drops in sales.

The Commerce Department also reported that “the number of vacant homes increased by 34% in 2006 to 2.1 million at the end of the year, nearly double the long-term vacancy rate.” (Marketwatch)

“The US economy is in danger of a recession that will prove unusually long and severe. By any measure it is in far worse shape than in 2001-02 and the unraveling of the housing bubble is clearly at hand. It seems that the continuous buoyancy of the financial markets is again deluding many people about the gravity of the economic situation.”

Dr. Kurt Richebacher

“The history of all hitherto society is the history of class struggles.”

Karl Marx

The bottom line is that inventories are up, sales are down, profits are eroding, and the building industry is facing a steady downturn well into the foreseeable future.

The ripple effects of the housing crash will be felt throughout the overall economy; shrinking GDP, slowing consumer spending and putting more workers in the growing unemployment lines.

Congress is now looking into the shabby lending practices that shoehorned millions of people into homes that they clearly cannot afford. But their efforts will have no affect on the loans that are already in place. $1 trillion in ARMs (Adjustable Rate Mortgages) are due to reset in 2007 which guarantees that millions of over-leveraged homeowners will default on their mortgages putting pressure on the banks and sending the economy into a tailspin. We are at the beginning of a major shake-up and there’s going to be a lot more blood on the tracks before things settle down.

The banks and mortgage lenders are scrambling for creative ways to keep people in their homes but the subprime market is already teetering and foreclosures are on the rise.

There’s no doubt now, that Fed chairman Alan Greenspan’s plan to pump zillions of dollars into the system via “low interest rates” has created the biggest monster-bubble of all time and set the stage for a deep economic retrenchment. Greenspan’s inflationary policies were designed to expand the “wealth gap” and create greater economic polarization between the classes. By the time the housing bubble deflates, millions of working class Americans will be left to pay off loans that are considerably higher than the current value of their home. This will inevitably create deeper societal divisions and, very likely, a permanent underclass of mortgage-slaves.

A shrewd economist and student of history like Greenspan knew exactly what the consequences of his low interest rates would be. The trap was set to lure in unsuspecting borrowers who felt they could augment their stagnant wages by joining the housing gold rush. It was a great way to mask a deteriorating economy by expanding personal debt.

The meltdown in housing will soon be felt in the stock market which appears to be lagging the real estate market by about 6 months. Soon, reality will set in on Wall Street just as it has in the housing sector and the “loose money” that Greenspan generated with his mighty printing press will flee to foreign shores.

It looks as though this may already be happening even though the stock market is still flying high. On Friday, the government reported that net capital inflows reversed from the requisite $70 billion to AN OUTFLOW OF $11 BILLION!

The current account deficit (which includes the trade deficit) is running at roughly $800 billion per year, which means that the US must attract about $70 billion per month of foreign investment (US Treasuries or securities) to compensate for America’s extravagant spending. When foreign investment falters, as it did in December, it puts downward pressure on the greenback to make up for the imbalance. Everbank’s Chuck Butler put it like this:

“Not only did the buying stop in December by foreigners in December, but the outflows were huge! Domestic investors increased their buying of long-term overseas securities from $37 billion to a record $46 billion. This is a classic illustration of ‘lack of funding’. So, the question I asked the desk was… ‘Why isn’t the euro skyrocketing?’”

Why, indeed? Why would central banks hold onto their flaccid greenbacks when the foundation which keeps it propped up has been removed?

The answer is complex but, in essence, the rest of the world has loaned the US a pair of crutches to bolster the wobbly dollar while they prepare for the eventual meltdown. China and Japan are currently hold over $1.7 trillion in US currency and US-based assets and can hardly afford to have the ground cut out from below the dollar.

There are, however, limits to the “generosity of strangers” and foreign banks will undoubtedly be pressed to take more extreme measures as it becomes apparent that Team Bush plans to produce as much red ink as humanly possible.

December’s figures indicate that foreign investment is drying up and the world is no longer eager to purchase America’s lavish debt. The only thing the Federal Reserve can do is raise interest rates to attract foreign capital or let the dollar fall in value. The problem, of course, is that if the Fed raises rates, the real estate market will collapse even faster which will strangle consumer spending and shrivel GDP. In other words, we are at the brink of two separate but related crises; an economic crisis and a currency crisis. That means that the unsuspecting American people are likely to be ground between the two mill-wheels of hyperinflation and shrinking growth.

In real terms, the economy is already in recession. The growth numbers are regularly massaged by the Commerce Department to put a smiley face on an underperforming economy. Industrial output continues to flag (In January it was down by another .5%) while millions good paying factory jobs are being air-mailed to China where labor is a mere fraction of the cost in the USA. Also, automobile inventories are up while factory production is in freefall.

In addition, new jobless claims soared to 357,000 in the week ending February 10. 44,000 more desperate workers have been given their pink slips so they can join the huddled masses in Bush’s Weimar Dystopia.

December’s net capital inflows are a grim snapshot of the looming disaster ahead. As the housing bubble loses steam, maxxed-out American consumers will face increasing job losses and mounting debt. At the same time, foreign investment will move to more promising markets in Asia and Europe causing a steep rise in interest rates. This is bound to be a stunning blow to the banks which are low on reserves ($44 billion) but have generated $4.5 trillion in shaky mortgage debt in the last 6 years.

It’s all bad news. The global liquidity bubble is limping towards the reef and when it hits it’ll send shock-waves through the global economic system.

Is it any wonder why the foreign central banks are so skittish about dumping the dollar? No one really relishes the idea of a quick slide into a global recession followed by years of agonizing recovery.

Maybe that’s why Secretary of Treasury Hank Paulson has reassembled the Plunge Protection Team and installed a hotline to his Chinese counterpart so he can quickly respond to sudden gyrations in the stock market or a freefalling greenback; two of the calamities he could be facing in the very near future.

Greenspan has successfully piloted the nation into virtual insolvency. In fact, the parallels between our present situation and the period preceding the Great Depression are striking. Just as massive debt was accumulating in the market from the purchase of stocks “on margin”, so too, mortgage debt between 2000 and 2006 soared from $4.8 trillion to $9.5 trillion. In both cases the “wealth effect” spawned a spending spree which looked like growth but was really the steady, insidious expansion of debt which generated economic activity. In both periods wages were either flat or declining and the gap between rich and working class was growing more extreme by the year. As Paul Alexander Gusmorino said in his article, “Main Causes of the Great Depression”:

"Many factors played a role in bringing about the depression; however, the main cause for the Great Depression was the combination of the greatly unequal distribution of wealth throughout the 1920's, and the extensive stock market speculation that took place during the latter part that same decade".

The same factors are at work today except that the speculation is in real estate rather than stocks. Just as in the 1920’s the equity bubble was not created by wages keeping pace with productivity (the healthy formula for growth) but by the expansion of personal debt. Also, one could buy stocks without the money to purchase them, just as one can buy a $600,000 or $700,000 house today with zero-down and no monthly payment on the principle for years to come. The current account deficit ($800 billion) could also weigh heavily in any economic shake-up that may be forthcoming. Bob Chapman of The International Forecaster made this shocking calculation about America’s out-of-control trade deficit:

"US debt was up 10.1% to $4.085 trillion and accounts for 58.8% of all the credit issued globally last year. That means the US expanded credit at a much faster rate than the economy grew. This was borrowing to maintain a higher standard of living and attempt to pay for it tomorrow."

Think about that; the US sucked up nearly 60% of ALL GLOBAL CREDIT in one year alone. That is truly astonishing.

There are many similarities between the pre-Depression era and our own. Paul Alexander Gusmorino says:

"The Great Depression was the worst economic slump ever in U.S. history, and one which spread to virtually all of the industrialized world. The depression began in late 1929 and lasted for about a decade....The excessive speculation in the late 1920's kept the stock market artificially high, but eventually lead to large market crashes. These market crashes, combined with the misdistribution of wealth, caused the American economy to capsize.

(The income disparity) between the rich and the middle class grew throughout the 1920's. While the disposable income per capita rose 9% from 1920 to 1929, those with income within the top 1% enjoyed a stupendous 75% increase in per capita disposable income…A major reason for this large and growing gap between the rich and the working-class people was the increased manufacturing output throughout this period. From 1923-1929 the average output per worker increased 32% in manufacturing8. During that same period of time average wages for manufacturing jobs increased only 8% (This ultimately causes a decrease in demand and leads to growth in credit spending)

The federal government also contributed to the growing gap between the rich and middle-class. Calvin Coolidge's (pro business) administration passed the Revenue Act of 1926, which reduced federal income and inheritance taxes dramatically…(At the same time) the Supreme Court ruled minimum-wage legislation unconstitutional.

The bottom three quarters of the population had an aggregate income of less than 45% of the combined national income; while the top 25% of the population took in more than 55% of the national income...Between 1925 and 1929 the total credit more than doubled from $1.38 billion to around $3 billion”. (Just like now, the growing wage gap has spawned massive speculative bubbles as well as a steady up-tick in credit spending. Wage stagnation forces workers to seek other opportunities for getting ahead. When wages fail to keep pace with productivity then demand naturally decreases and business begins to flag. The only way to spur more buying is by easing interest rates or expanding personal credit, and that is when equity bubbles begin to appear. That's what happened to the stock market before 1929 as well as to the real estate market in 2007. The availability of credit has kept the housing market afloat but, ultimately, the resultwill be the same.

On Monday October 21, 1929, the over-valued stock market began its downward plunge. It managed a brief mid-week comeback, but 7 days later on Black Tuesday it plummeted again; 16 million shares were dumped and there were no buyers.

The game was over.

Confidence evaporated overnight. People stopped buying on credit, the bubble-economy collapsed, and the mighty locomotive for growth, the American consumer, hobbled into the Great Depression. Tariffs were thrown up, foreigners stopped buying American goods; banks closed, business went bust, and unemployment skyrocketed. Tens years later the country was still reeling from the implosion.

Now, 77 years later, Greenspan has led us sheep-like to the same precipice. The economic dilemma we’re facing could have been avoided if the expansion of personal credit had been curtailed by prudent monetary policy at the Federal Reserve and if wealth was more evenly distributed as it was in the ‘60s and ‘70s. But that’s not the case; so we’re headed for hard times.

Housing Bubble vs. Great Depression

Krugman on the US housing bubble

Housing Bubble: Market Crashing? Yes, In Slow Motion.

![Brotherhood" (2006) [TV-Series]](http://photos1.blogger.com/x/blogger2/1421/379621144723082/211/z/425926/gse_multipart33129.jpg)

No comments:

Post a Comment